Introduction

BBMP Property Tax Online Payment: If you own property in Bangalore, you must pay a yearly tax to the city’s municipality, “BRUHAT Bangalore MAHANAGARA PALIKE” (BBMP). This money is used to improve the city’s facilities. The tax amount is calculated using a system called Unit Area Value (UAV), which considers your property’s location and usage.

UAV Calculation: UAV is determined based on property details like location and usage. To calculate the tax, the current property value is multiplied by the property’s square footage.

Zoning and Tax Rates: Bangalore is divided into six zones by the stamps and registration department. Property tax varies based on property use (rented or occupied) and the zone it’s in.

Payment Options: You can pay property tax online or offline.

How to Pay BBMP Property Tax Online through BBMP Tax Portal?

To know more about this, follow this Simple steps given below:

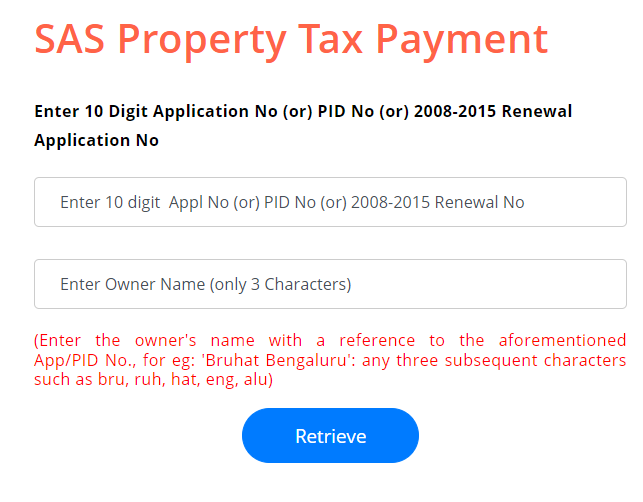

- Go to the official BBMP property tax portal: https://bbmptax.karnataka.gov.in/.

- Enter your PID number and the first three letters of the property owner’s name.

- Click “Retrieve” to get your property details.

- Review the details and click “Proceed” to reach Form IV.

- If changes are needed, tick the box and click “Proceed” for Form V.

- Choose online payment, then pay using net banking or a card.

- Allow 24 hours for payment status to appear on the portal.

- For help, email bbcrev@gov.in.

How To Pay BBMP Property Tax Manually?

To know more about this, follow this Simple steps given below:

For Manual Payment:

- Visit the Revenue Office.

- Get the tax payment form.

- Fill it out and submit to the office.

- Pay by Card or Demand Draft.

For e-challan:

- Use banks like IDBI, cooperative bank, SBI, Maharashtra bank.

- Fill the form online.

- Pay property tax as e-challan at these banks.

How to Check Status of BBMP Tax Payment Application?

After paying BBMP tax online, you can check its status:

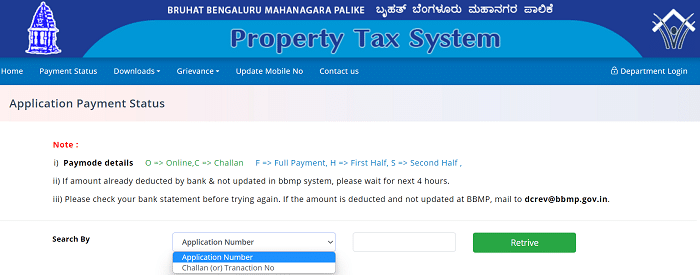

- Visit the official BBMP property tax portal.

- Click “Payment Status” on the homepage.

- Choose Application Number or Challan/Transaction Number.

- Enter the number and click “Retrieve.”

- See the payment status displayed on the screen.

How to Download BBMP Property Tax Receipt?

To get your property tax receipt:

- Visit BBMP tax property portal.

- Click “Downloads.”

- Choose “Print Receipt.”

- Pick assessment year, add app number, captcha, and click submit.

- Download your property tax receipt in PDF.

When to Pay BBMP Property Tax to Get Rebate?

To get a rebate, pay your BBMP property tax by March 31 of the following year. For example, for FY 2022-23, pay by March 31, 2023.

- You can also save 5% by paying in full within the due date. If you’re late, there’s a 2% monthly (24% yearly) penalty.

- You can pay in instalments, but without a rebate.

How to Calculate BBMP Property Tax?

Property tax is typically 20% of the property’s total area multiplied by the BBMP’s Sq Ft value. This tax covers occupied and rented spaces, including parking.

The formula for property tax is:

Property Tax (K) = (G – I) * 20% + Cess (24% of property tax)

Where:

G = Gross unit area value (X + Y + Z) I = G * H / 100

X = Rented area * Sq ft rate per property * 10 months

Y = Self-occupied area * Sq ft rate per property * 10 months

Z = Parking area * Sq ft rate per parking area * 10 months

H = Percentage depreciation based on property age

This calculation accounts for the property’s age, allowing for BBMP plus 24% cess property tax.

BBMP Tax Forms:

For BBMP tax payment, there are 6 forms that need to be submitted, depending on the property situation:

- Form 1: For properties with a property identification number (PID) containing street and ward numbers. This information is usually found in the last tax payment. These properties were part of the previous BBMP and the form is white.

- Form 2: For properties with a Khata number but lacking a relevant PID. These properties were previously under CMC and TMC and the form is pink.

- Form 3: For properties without both PID and Khata numbers, often unauthorized properties. This includes sanitation details and the form is green.

- Form 4: Used when there are no changes in property details like usage or occupancy. The form is white.

- Form 5: If there’s a change from residential to nonresidential property usage. The form is blue.

- Form 6: For properties exempt from tax payment. The form is white.

Each form corresponds to different property scenarios and has a specific color code for easy identification.

BBMP Latest News:

Bruhat Bangalore Mahanagara Palike (BBMP) is currently in the process of considering the acquisition of land from 118 private property owners along the Rajakaluvas area. This initiative aims to enhance the width of Storm Water Drains in response to the issue of rising water levels that exceed the acceptable threshold during flood events. In light of these concerns and the need to mitigate flood-related challenges, BBMP has taken the decision to expand the scope of the Storm Water Drains.

This proactive approach is intended to bolster the city’s infrastructure and better manage the impact of heavy rainfall and flooding. By acquiring the necessary land from private property owners, BBMP aims to create a more effective drainage system that can handle increased water flow, ultimately contributing to the overall resilience of the city’s flood management efforts.